Coverage of Residential Earthquake Basic Insurance

◎ The following perils are covered by basic residential earthquake:

1. Earthquakes

2. Fire or explosion caused by an earthquake

3. Landslide, land subsidence, land movement, fissure, or rupture caused by an earthquake.

4. Tsunami, sea surge or flood caused by an earthquake.

If two or more of the above-mentioned perils occur within above 168 hours of each other, they shall be treated as one earthquake incident.

◎ The operations of residential earthquake insurance are limited to the following:

1. Operations related to automatic coverage under "residential fire and earthquake basic insurance"

policies approved by the authorities.

2. Operations related to one-year basic earthquake insurance for holders of long-term residential fire

insurance policies with effective riders.

3. Operations related to earthquake basic insurance coverage under residential fire insurance, comprehensive

residential insurance, and residential earthquake insurance policies self-developed by the non-life insurers.

Insured Amount

The insured amount for basic residential earthquake insurance is calculated based on the replacement cost of the residence. The replacement cost is the total construction cost of the building as listed under the "Table of Residential Construction Costs in the Taiwan Area by Type" published by the Non-Life Insurance Association of the R.O.C. at the time the policy was taken out. However, the insured amount may not exceed NT$1.5 million.

If adjustments are made to the construction costs under the "Table of Residential Construction Costs in the Taiwan Area by Type," the policyholder may, in reference to the adjustment and with written approval of the insurer, adjust the coverage amount up to a maximum adjusted insured amount of NT$1.5 million.

Premium

The annual flat premium is NT$1,350 based on an insured amount of NT$1.5 million.

Claims Standards

In addition to the insured amount for total loss of residence, additional coverage of NT$200,000 per dwelling will be provided for contingent living expense in the event of the total destruction of the insured dwelling. Total loss refers to cases meeting any of the following circumstances:

1. The government has issued a notification or order for residence demolishing or directly demolished

the residence.

2. It is determined by assessment of a qualified loss adjustor or appraisal by the Architects Association or

a professional association for building structure, civil engineering or geoscience in Taiwan that the

residence is uninhabitable or the repair cost would equal or exceed 50% of the replacement cost.

A qualified loss adjustor refers to a non-life insurance claim adjustor or insurance surveyor that has undergone the "Earthquake Building Damage Assessor" training program held by the agency designated by the authorities, and who has obtained a certification of training qualification.

Residential Earthquake Insurance Risk Spreading Mechanism and Introduction

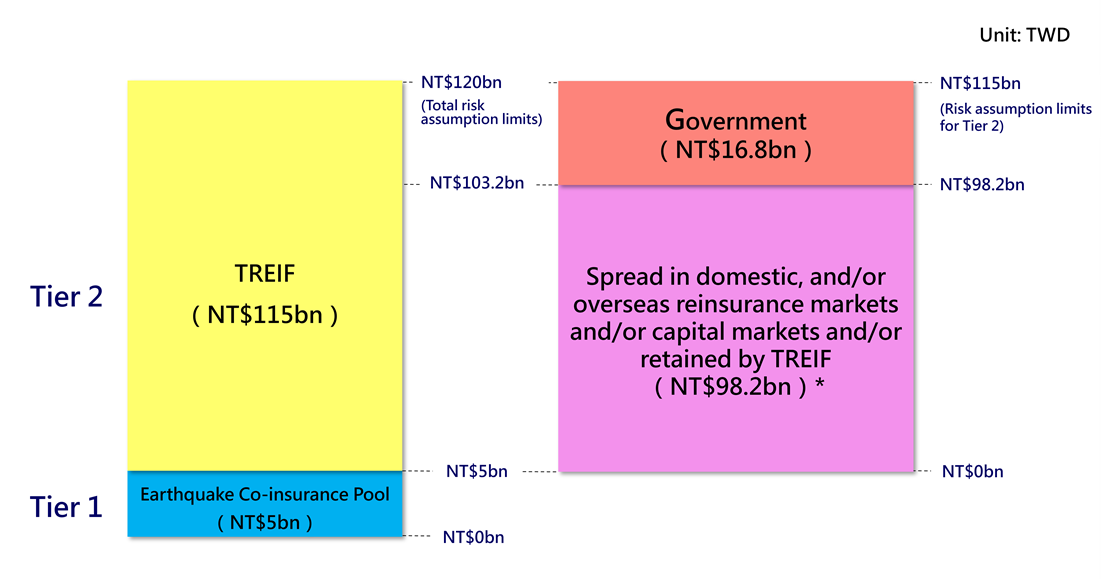

1.Chart for the Residential Earthquake Insurance Risk Spreading Mechanism

2.Risk Spreading Mechanism since 2024/4/1:

A.First-tier liabilities: NT$5 billion, assumed by a residential earthquake insurance pool.

B.Second-tier liabilities: NT$115 billion, assumed and spread by TREIF.

3.The amount of liabilities assumed and spread by TREIF:

(1) The portion up to and including NT$98.2 billion shall be spread in domestic, and/or overseas reinsurance markets and/or capital markets and/or retained by TREIF.

(2) The portion exceeding NT$98.2 billion and up to NT$115 billion shall be assumed by the government.

*Note 1: A US$100 million Catastrophe Bond was issued from 2003 to 2006 as risk spreading mechanism for the portion exceeding NT$20 billion in the Second-tier liabilities.

*Note 2: A five-layer reinsurance (NT$50 billion) has been arranged for the portion exceeding NT$20 billion in the Second-tier liabilities since 2024/7/1.

4.Each tier of risk limit is calculated on the basis of the insurance loss for each earthquake incident.

If the total amount of the insured loss from the same earthquake incident exceeds the total amount of Risk

Spreading Mechanism, the claim amount paid to the policyholder shall be on a pro rata basis

proportionally reduced.

5.The TREIF may regularly review and propose that the authorities duly adjust the risk limits for each

tier in view of the underwriting and claims situation of the residential earthquake insurance.